tax benefit rule definition and examples

Thesaurus for Tax benefit rule. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross.

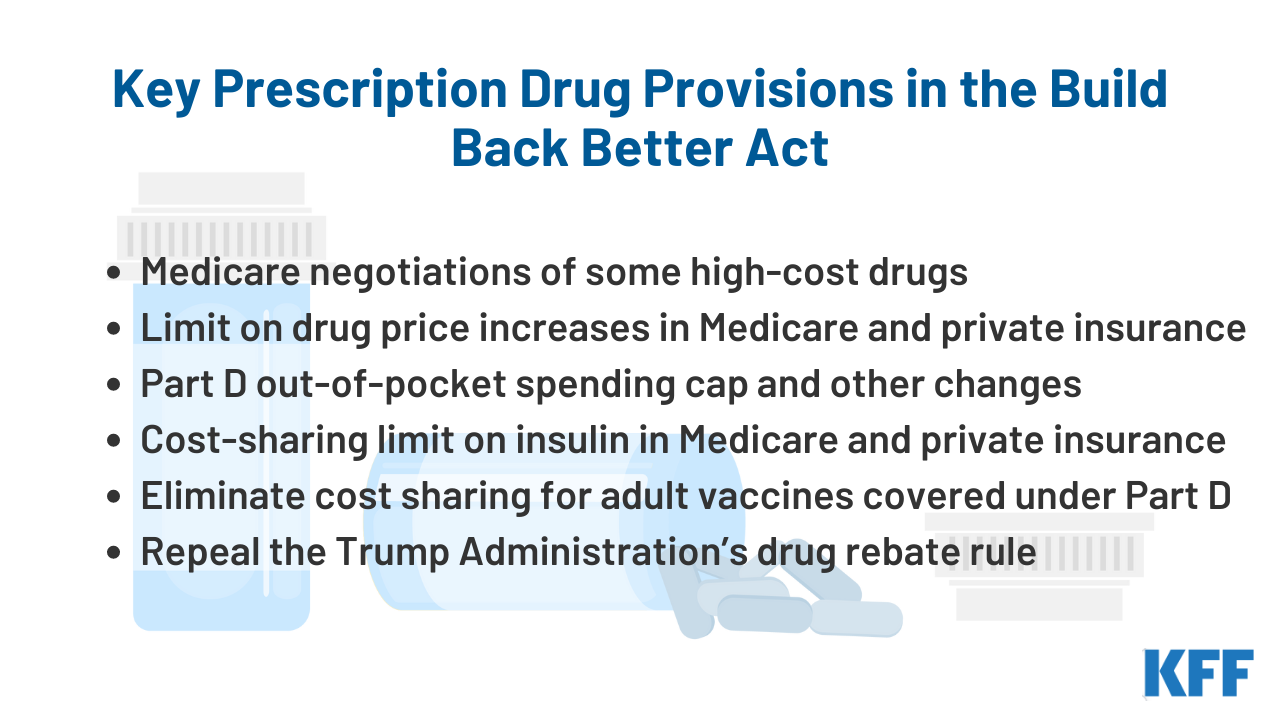

Explaining The Prescription Drug Provisions In The Build Back Better Act Kff

Examples of tax benefit.

. Offset income up to 3000 in losses. In 2019 A received a 1500 refund of state income taxes paid in 2018. A tax benefit in the prior taxable year from that itemized deduction.

C received a tax benefit from 500 of the overpayment of state income tax in 2018. Legal Definition of tax benefit rule. A tax deduction that is granted in order to encourage a particular type of commercial activity.

Examples of tax benefit. A tax provision that says a donor who receives a tangible benefit from making a charitable contribution must subtract the value of that benefit from the amount claimed as an. The term tax benefit refers to any tax law that helps you reduce your tax liability.

A taxpayer itemized in 2011 and deducted state income taxes paid in 2011. Payroll taxes used to finance social. Consider a taxpayer who pays 10000 of state income taxes in year 1.

State income tax refund fully includable. Benefits Limitations of Harvesting Tax Losses Benefits of Tax-Loss Harvesting. Under the benefit principle taxes are seen as.

Most related wordsphrases with sentence examples define Tax benefit rule meaning and usage. The tax benefit is the lessor of the actual deduction claimed or the amount the deduction causes your total itemized deductions to exceed your applicable Standard Deduction. What is the Tax Benefit Rule.

Whats the definition of Tax benefit rule in thesaurus. The tax benefit rule is intended to ensure that companies do not write off debt with the intention of collecting it later and not paying taxes on it. Tax-Benefit Rule Law and Legal Definition.

A taxpayer used a standard deduction in 2011. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a. Offset capital gains dollar for dollar.

Tax benefit rule is a judicially created doctrine seeking to repair some of the inflexibility inherent in the annual accounting system. Tax benefits include tax credits tax deductions and tax deferrals. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a.

Example of the Tax Benefit Rule. However in 2012 the taxpayer receives a state tax refund. A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden.

Its also the name of an IRS rule requiring companies to pay taxes on income. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the. For example if an employee who is required to be away from home overnight for rest is given meals the meals.

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Tax Benefit Meaning Examples How Tax Benefit Works

Are Personal Loans Tax Deductible Common Faqs

Annuity Taxation How Various Annuities Are Taxed

Standard Deduction Tax Exemption And Deduction Taxact Blog

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

How Does The State And Local Tax Deduction Work Ramseysolutions Com

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

What Is The R D Tax Credit And Could Your Company Qualify

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

What Is Imputed Income Bamboohr

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

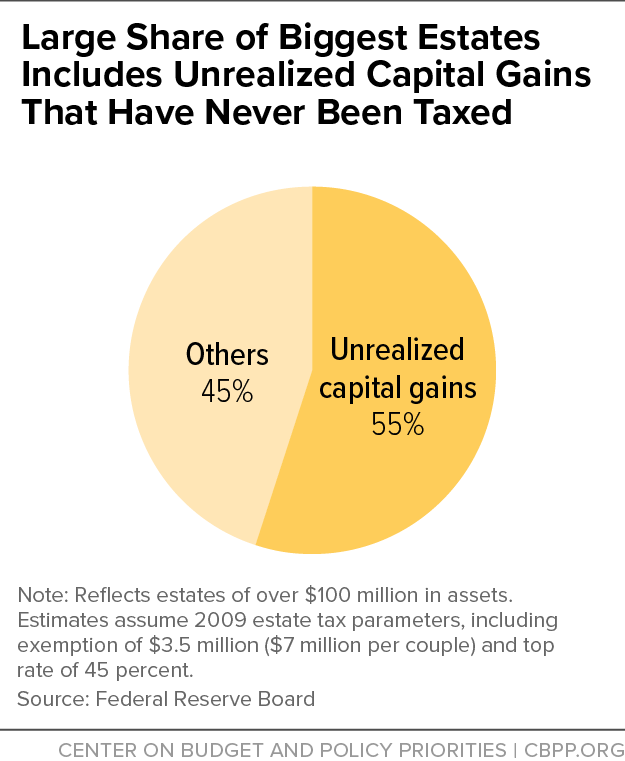

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Old Vs New Tax Regime Which One Should You Choose Forbes Advisor India

:max_bytes(150000):strip_icc()/rothira_final-e893b63825fd418fa3787f38361be956.jpg)